Finance and Budget

We endeavor to be transparent in our decision-making and financial affairs to allow our taxpayers and the district’s voters to have access to information needed to assess if we are making efficient use of public funds and providing good value for the cost of our services.

The district’s current and historical budget documents and annual financial reports, as well as financial and accountability audits are accessible here on the finance and budget page. The district’s budget documents serve as a policy document, as an operations guide, as a financial plan, and as a communications device to tell our taxpayers and voters what we are doing with the district’s financial resources.

The district’s financial transactions and financial report are submitted to the board of fire commissioners on a monthly basis and those documents are accessible from the fire commissioners page.

CWIFR’s long-term financial plan is a key component of the district’s integrated comprehensive plan. This plan has a 10-year horizon and examines economic influences on the district as well as projected revenue and expenses to provide a framework for understanding the district’s financial position and provide guidance for fiscal decision-making. The long-term financial plan is accessible from the planning page.

How is CWIFR Funded?

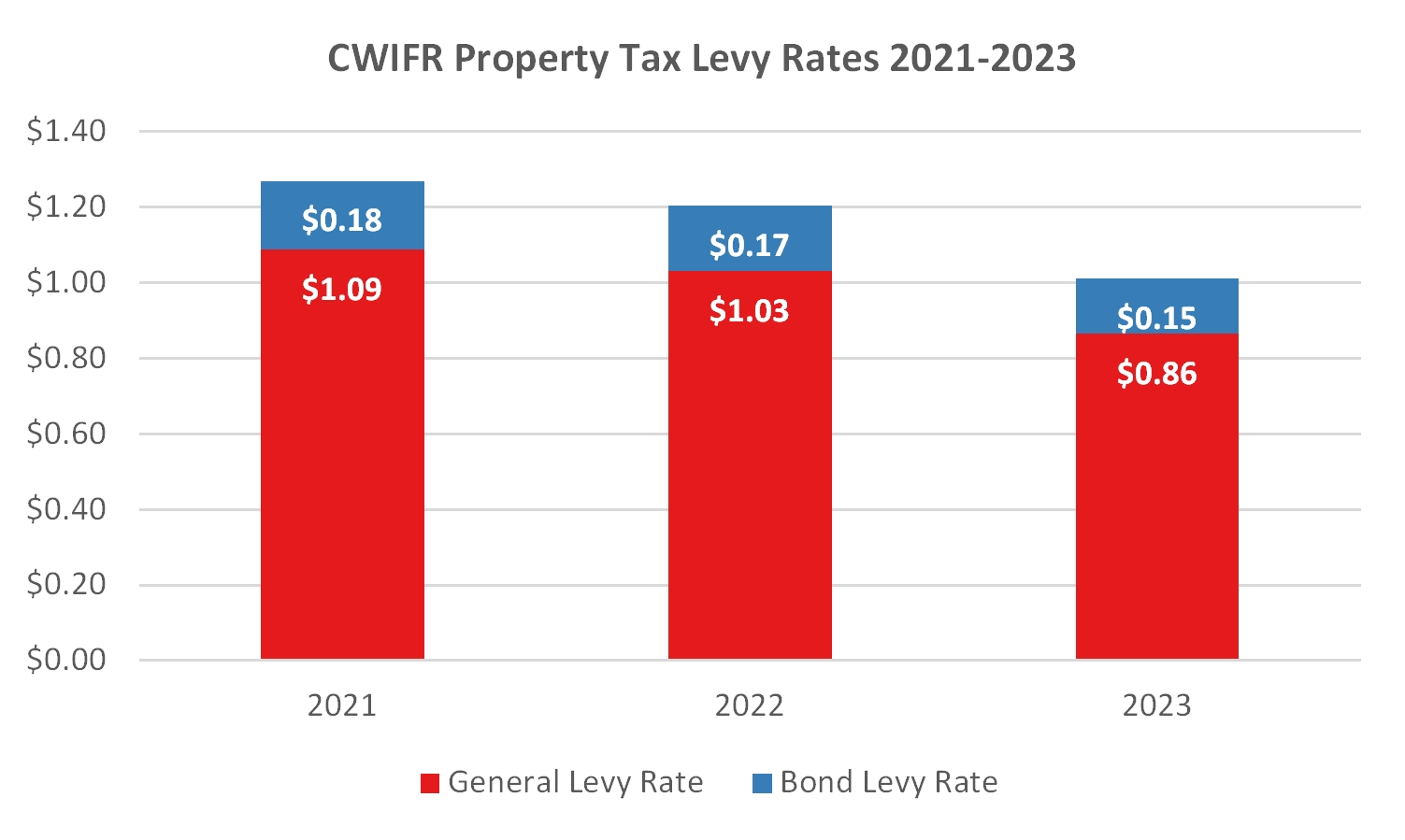

CWIFR is a fire protection district established under the provision of Title 52 Revised Code of Washington (RCW) and is funded predominantly through taxes on property within the district that have buildings. The district has two property tax levies, the general levy for maintenance and operations and the voter approved bond levy for specific capital projects (purchase of three fire engines and expansion of Station 53 on Race Road). The district’s other ongoing revenue streams are from providing services to other local and state governmental entities through interlocal agreements (ILA). This includes an ILA with WhidbeyHealth to staff a basic life support ambulance. In addition, the district has a number of other smaller ongoing or one-time revenue sources.

How do Property Taxes Work?

Washington state property taxes are complicated! The simple explanation is that increases in the total amount of property tax levied is limited to 1% per year (plus the value of new construction added to the property tax rolls). It is important to note that this does not apply to excess levies such as the bond measure for specific capital projects passed by the district’s voters in 2017. The district’s assessed valuation (AV) is divided by the total amount of property tax that may be levied determines the levy rate per $1000 assessed valuation. This means that if assessed valuation goes up, the levy rate goes down and if assessed valuation goes down, the levy rate goes up (until it hits the statutory maximum for fire district’s which is $1.50/$1000 AV).

What are the District's Expenses?

CWIFR uses a combination of full-time and part-time employees as well as volunteers to deliver services to the community from three fire stations using four structural firefighting engines, three water tenders, two bush fire engines, a marine rescue boat, and other support apparatus. Personal services (salary, wages, volunteer stipends, and benefits) comprise the majority of districts expense. In addition, the district must maintain and operate fire stations and apparatus as well as setting funds aside for future capital projects and liabilities.

Planning and Budgeting

Long term financial planning involves resource and requirements forecasting and strategizing how to meet both the current and future needs of the community. Preparing for an uncertain future requires consideration of a wide range of factors as well as direct and indirect influences on Central Whidbey Island Fire & Rescue’s success in providing the community’s desired service delivery level on a sustainable basis. Each of the elements of the district’s integrated comprehensive plan (ICP) influences the development of the annual operating and capital budgets. However, the long-term financial plan and capital projects plan have a direct impact on the development of the annual budget. The components of CWIFR’s ICP are accessible from the planning page.

The district uses a bottom-up, modified zero-based budgeting process in which project, program, and division managers build and present the budget proposals for review by the deputy chief, finance officer, and fire chief prior to finalizing the proposed district budget for submittal to the board of fire commissioners. The budget is closely aligned with the district’s strategic goals, initiatives, and performance measures.

Central Whidbey Island Fire & Rescue has received the Government Finance Officers Association (GFOA) Distinguished Budget Presentation Award for seven consecutive years. This award recognizes the district’s commitment to best practice and excellence in budgeting. In order to receive this award, the district’s budget document must meet published criteria for effectiveness as a policy document, an operations guide, a financial plan, and a communications device.

Financial Reporting

The district’s finance officer provides the board of fire commissioners several financial reports on a monthly basis, these include the monthly budget position and check register. These reports can be downloaded from the fire commissioners page of the district website.

As a municipal entity in the state of Washington, the district is required to file an annual financial report with the State Auditor’s Office (SAO). This report provides financial information in a standardized format that allows comparison across similar agencies. The district’s financial data is also available using the SAO Financial Intelligence Tool (FIT). The Office of the Washington State Auditor has developed the Financial Intelligence Tool (FIT) to provide financial transparency into local governments within Washington. When using the FIT search for Island County Fire District 5 (Central Whidbey Island Fire & Rescue).

Internal and External Audits

Annually, the board of fire commissioner selects one commissioner to serve as the district’s internal auditor. This commissioner reviews district financial records on a recurring, but unannounced schedule throughout the year as a key element of internal financial control.

In addition, as with all municipal entities, Central Whidbey Island Fire & Rescue (CWIFR) is regularly audited by the Washington State Auditor’s Office (SAO). CWIFR receives an annual financial and accountability audit from the SAO on a biannual basis (for the preceding two years). The district has completed all audits since 1986 without a finding. When using the SAO Audit Report Database search for Island County Fire District 5 (Central Whidbey Island Fire & Rescue).

Bond Rating

A bond rating is a grade given to a bond by a rating service that indicates its credit quality. The rating takes into consideration a bond issuer’s financial strength or its ability to pay a bond’s principal and interest in a timely fashion. Central Whidbey Island Fire & Rescue is one of the few fire districts in the nation that has received a AAA bond rating from Standard and Poor’s.

Procurement

The district’s procurement guidelines provide a uniform method of procurement and purchasing procedures for equipment, materials, services, and public works projects that is consistent with District policy, Revised Code of Washington (RCW) Washington Administrative Code (WAC), and guidance provided by the Washington State Auditor. These guidelines define the authority for expenditure of funds, requiring board approval for single purchase expenditures exceeding $10,000 and authorization by board resolution for sole source procurements exceeding $10,000.

All district expenditures are presented in the monthly financial transactions report to the board of fire commissioners. Bids and contracts for purchases exceeding $10,000 are available for review so our stakeholders can evaluate the contract and evaluate if the district chose the best solution for the community.